GameStonks Stock Market Bubble Daytrading Game

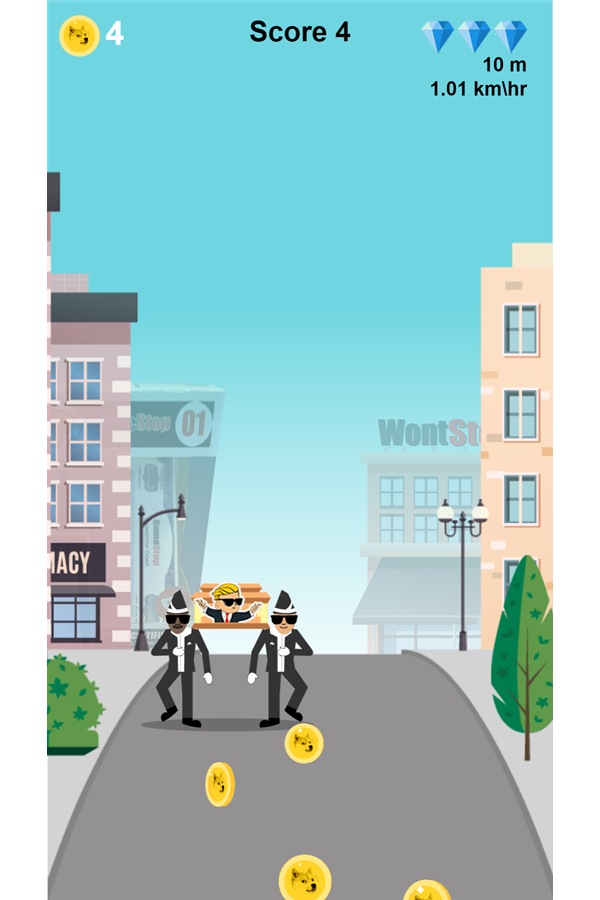

This is a simple game where players collect chicken tenders and Dogecoin.

- If any tendies hit the ground the game is over.

- Each time you bump into an object you lose one of your three lives.

- This game is rich in Reddit-themed imagery: diamond hands, paper hands, YOLO, a rocket ship, etc.

Play GameStonks Online

You can play this game inside this webpage below by tapping on the screen or clicking your mouse.

Alternatively you can play this game as a web application .

GameStonk Game Play Instructions

How to Play

This is a coin collecting game where players must prevent falling chicken tenders from touching the ground by catching them with a casket.

- Locate your web browser to Robinhoo… only kidding.

- Players collect DOGE coins while trying to save chicken nuggets that are falling from the sky.

- Players get up to 3 lives, which they lose any time they bump into a frightening obstacle including a bear, construction signs, or paper hands.

- Hitting a rocket temporarily doubles point counts.

- Bumping into YOLO causes your character to behave erratically.

- If you hit diamond hands you are temporarily invincible.

- If any chicken nuggets / chicken tenders (or as they are called on Reddit – tendies) hit the ground it is game over – you die immediately.

Like This Game? Review Game Stonks

GameStonks Game Screenshots

Mobile Friendly Cross Browser Support

This game is rendered in mobile-friendly HTML5, so it offers cross-device gameplay. You can play it on mobile devices like Apple iPhones, Google Android powered cell phones from manufactures like Samsung, tablets like the iPad or Kindle Fire, laptops, and Windows-powered desktop computers. All game files are stored locally in your web browser cache. This game works in Apple Safari, Google Chrome, Microsoft Edge, Mozilla Firefox, Opera and other modern web browsers.

Background Story of This Game

The theme of this game comes from the rapid rise of GameStop ($GME) stock share price due to a gamma squeeze followed by momentum investors and degenerate gamblers daytrading stock on /r/WallStreetBets.

While YOLO may be true, memes never get old.™

The GameStop Company

- The company is a video game retailer beloved by many a basement dweller like me. It was founded in 1984 and is a popular retailer of video games where many people go to buy new or used games and trade in older games they have already played.

- Some video game consoles are delivering games online and there is a rapid rise in both mobile gaming on phones and delivery of games over the internet from services like Steam.

- In late 2020 former Chewy CEO Ryan Cohen bought 9.98% of the company’s shares at an average cost of $5.98 per share, encouraging them to invest aggressively in ecommerce.

- Famed investor Michael Burry, who was profiled in The Big Short, also took a large stake in the company last year.

- GameStop did not sell new shares into the bubble on the basis they were afraid of committing securities violations.

Hedge Funds & International Investors

- Some hedge funds bet GameStop was going to collapse and tried to drive it toward collapse through shorting over 100% of the float, effectively counterfeiting shares.

- Many hedge funds run similar books where they are long the FANG-type plays and short dying retailers & other similar fading companies.

- When one hedge fund gets caught offsides in a big way that can lead them to have to liquidate both sides of their book, generating losses for the next hedge fund, which then have to liquidate, which generates losses for the next hedge fund in a giant beautiful daisy chain.

- Hedge funds got short squeezed by a variety of players and then momentum sucked more people into the trade.

- GameStop shorter Melvin Capital clocked in an impressive 53% loss in January. Melvin Capital received a multi-billion dollar bail out by Citadel and Point72.

- The theme of the outsized GameStop story was that small retail traders at home were moving the stock & other meme stocks, however the fund flows indicate some larger institutional investors working at hedge funds were also highly involved. Senvest Management made a $700 million profit on a position they began establishing in September. Maverick Capital also had a large long position.

- Bond king Bill Gross made $10 million shorting GameStop.

- Kuppy kept selling GameStop volatility.

Retail Traders

- Keith Patrick Gill, known as DeepF___ingValue or The Roaring Kitty began buying GameStock stock and call options in 2019 and posted about it publicly back then, which encouraged others to mimic his trade. While he was ultimately proven correct and his $50,000ish bet turned into $10s of millions, he was also a registered broker, so his promotion of $GME has federal regulators looking into the situation.

- The stock was discussed widely on a Reddit subreddit forum named WallStreetBets.

- Here is a great thread from September 8 predicting the gama squeeze which happened in January.

- Tesla CEO Elon Musk tweeted #GameStonk to piss off short sellers who had screwed with him for years.

- Venture Capitalist Chamath Palihapitiya tweeted about buying a call option on GameStop, further driving a price ramp. He closed that position the next day and donated the profits from that trade to the Barstool Fund, which helps small businesses.

- The stock peaked at $483 per share on January 28, 2021, rising from a 52-week low of $2.57 a share on April 3, 2020. On January 28th over a million shares failed to deliver.

- Part of what caused the stock momentum to disappear was Robinhood could not meet a $3 billion security deposit request from NSCC. Robinhood lowered the requested capital call by setting $GME and a few other meme stocks like $AMC to sell only. They also force sold customer stocks and now face dozens of lawsuits. David Portnoy called them criminal. Robinhood earned thousands of one-star ratings for the fiasco and raised billions from investors to deal with the fall out.

- Barstool Sports founder David Portnoy took a $700,000 loss on meme stocks like AMC and Nokia. In the video announcing that loss he said he had never owned GameStop stock.

- After the WallStreetBets and GameStop story captured the broader public zeitgeist old moderators of the WSB forum came back to kick out newer moderators. Everyone is trying to monetize the story. Some of the audience moved over to WallStreetBetsnew and WallStreetBetsOGs.

- We launched this game on February 4th. On that day $GME closed at $53.50, off a comfortable 42.11% on the day and a cool 89% from the high a week prior.

- The day after this game was launched Robinhood removed GME & AMC purchase order limits. GameStop jumed from a Thursday close of $53.50 to a high of $95 (up 77.57%), with the stock again having trades halted multiple times. The bid / ask offer spread was often between 50 cents and $1 throughout much of the day, meaning market makers likely made tens of millions of dollars on Friday’s trade volume of 79,541,313 shares. The stock closed the day at $63.77 (up 19.2%).

- Other markets which have been targeted by WSB have seen increasing margin requirements to curtail risk.

- Yahoo! conducted a Harris Poll which found 28% of Americans traded “meme” stocks like GameStop in January. Many bought GameStop to try to pay off debts.

- Mortgage company Rocket surged 109% as a day trader favorite. It later had 33% down days.

- Speculators have moved from other meme stocks to themes like silver, marijuana companies, cryptocurrencies like Bitcoin and Dogecoin, and even a levered ETF tied to volallity itself.

- David Portnoy promoted the Van Eck Vectors Social Sentiment ETF, an ETF based on online sentiment. It promotes larger cap stocks with strong online sentiment instead of promoting the GameStop type momentum stocks.

Regulators

- Spam bots widely hyped meme stocks on Reddit and other social media networks.

- Some politicians are considering financial transaction taxes to curtail high frequency trading which is driven by payment for order flow to brokers which allows entities like Citidel, Virtu, Susquehanna, Two Signa, UBS and Wolverine to monetize the spread between best bid or offer.

- Robinhood’s CEO, along with executives from Reddit, Melvin Capital and Citadel spoke before the House of Representitives on February 18th. Robinhood is trying to settle a FINRA probe.

- On February 19th the SEC temporarily suspended trading in 3 meme stocks: Marathon Group Corp, Affinity Beverage Group Inc, and Sylios Corp.

Lawsuits

- Robinhood faces a wave of lawsuits for disabling user trading.

- Keith Patrick Gill was sued by other investors who lost money taking the wrong side of the trade. The day after he appeared before congress he posted a screenshot of his brokerage account showing he had doubled his $GME share position, buying an additional 50,000 shares. GameStop’s share price quickly doubled again after he showed his increased position size.

History

- While some have seen the GameStop phenomena as something unique, a similar short squeeze happened back in 1923 to a Southern and Midwest grocery store chain named Piggly Wiggly. Piggly Wiggly was the first self-serve grocery store and still exists today as a subsidiary of C&S Wholesale Grocers.

- Volkswagen’s shares were also squeezed in 2008.

Marketing This Game

This game as an experiment in online marketing bombed spectacularly for a number of reasons …

- The game was far less polished than many of our other games.

- The game was simply a light reskin of this coffin dancer game.

- As this site was new it was prohibited from advertising on networks like Twitter.

- Reddit was overrun with bots and spam, so mentions there went nowhere too.

- While we have been avid gameplayers for decades we have never promoted ourselves in that category. My wife plays a ton of MMORPGs and could have seeded this site spreading across Discord, Twitch, and others – but she thought I was an idiot for buying this domain and creating yet another website, so now I have to make it a success as a matter of personal pride & if she plays any roll in that I will get to hear lectures about how she pioneered the success and my thousands of hours of labor did not matter at all. 😉

Going forward I have realized in the polarizing and cynical modern internet even altruism and humor are treated with deep cynicism, so it helps to have relationships in advance or be well known before doing any sort of marketing if you want to do something beyond a faceplant performance artpiece. This is part of the reason we decided to publish a bunch more fun games right away so that our site will hopefully be somewhat well established such that next time we have a marketing idea there is a chance people might be a bit more receptive than the cold shoulder our first try generated.

Where To? What Next?

This game was published in these categories: Mobile, Tap. You can visit any of them to select other fun games to play.

Our site hosts thousands of free online games. Check out the newest additions to our library or play a random game!

This game was published using our teamwide CardGames.pro account. If you have any comments, questions, concerns, or others (are there others even???) you can use the comments below to send along your 2 cents and help us improve the site further :) Your 2 cents plus 3 cents will buy you a nickel, but if your comments are genuinely useful and/or helpful and/or funny and/or memorable in a good way, we will probably say thanks :D

Search And Find And CardGames.pro Your Free Online Games :)